- Frameworks & Finance

- Posts

- 3 types of freedom

3 types of freedom

What they are and the importance of patience and balance

PRESENTED BY:

In some sense, everyone is chasing freedom.

Financial freedom, time freedom, location freedom, and more.

But most are chasing them wrong.

Today I break down what I’m coining “The 3 Pillars of Freedom” and how we can achieve them together.

If you were forwarded this email, my goal is to share one thing each week that changes the way you think about money. Subscribe below:

A MESSAGE FROM WTFINTECH?

Diversity meets the fintech industry

The fintech industry isn’t exactly known for its diversity. WTF is up with that?

Nicole Casperson is a reporter-turned-creator who’s quickly becoming one of the most important new voices in fintech. Each week, Nicole writes the WTFintech? newsletter with informative stories on startups, new technologies, and emerging female leaders.

Be the change you want to see. Subscribe to WTFintech? today.

3 types of freedom

For many people around the world, the COVID-19 pandemic changed everything.

Some lost friends and family, but even more, they reevaluated their life.

Pew Research recently asked Americans where they find life meaning, repeating a survey they did in 2017. While the survey was only separated by 4 years, the results were extremely different.

In 2017, Material well-being and Career were the clear winners when it came to where people found meaning. But, after the pandemic, they dropped a combined 18 percentage points while Society and Freedom saw the biggest gains (by 10 percentage points combined).

When you take the biggest increases and decreases into account, it’s clear that what people value has changed pretty drastically. Before they valued “success” and now they value “freedom.”

As more people reevaluate their career goals, freedom (time, location, etc) has become a common theme that job seekers are looking for.

Often, people talk about financial freedom. Grant Sabatier even came out with 7 levels of financial freedom.

But, financial freedom is just the beginning… people are seeking other types of freedom as well.

I recently interviewed Brian Lueben for my podcast, and he talked about 3 types of freedom:

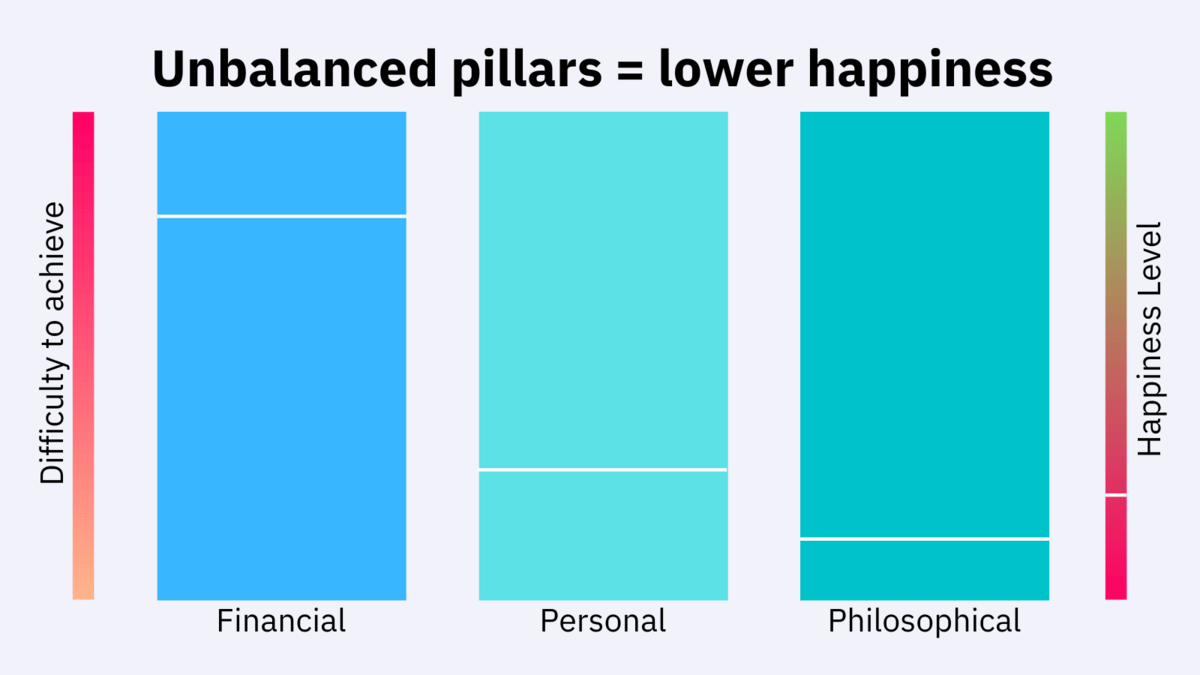

Financial

Personal

Philosophical

Brian defined them as follows:

Financial Freedom means having enough passive income from investments (stock market, real estate, business, etc) to cover your expenses indefinitely.

Personal freedom is having complete control of your schedule. As he says you can do “what you want, when you want, with who you want.”

Philosophical freedom is the freedom to think beyond yourself (WE over ME… a little WeWork/Adam Neumann vibes anyone?). It’s thinking about fulfillment and helping others because your needs are met.

I decided I’d call these the Pillars of Freedom.

The connected nature of the pillars

While not a concrete model, I see the pillars as interconnected, but also independent units.

Financial success can be achieved without the others, but failing to attend to personal and philosophical freedom will limit happiness and fulfillment.

As you attend to the other pillars, your fulfillment shoots up because you’re more balanced (see the happiness bar).

While success in one pillar can lift the other pillars up, there are limits.

We see this clearly with billionaires.

To become that wealthy, there is a significant focus on achieving financial freedom. But, the chase required for this level of financial freedom limits their personal and philosophical freedom initially.

As they continue to gain wealth, they can use the money to “buy” personal and philosophical freedom.

You see marriages struggle because of misalignment in personal freedom, but their wealth allows them to “correct” those wrongs with the next partner. Example: Jeff Bezos.

For some, their choice of gaining richest may not be fulfilling, as they chose the path with the greatest potential gains (ie. asymmetrical bets). So, to regain philosophical freedom, they donate money to charities they care about. Example: The Giving Pledge.

It seems almost impossible to live balanced when at the extremes in one area, so the goal (and the goal I think most want) is to chase them all together.

As you do this, they each start to lift the others, making the overall journey easier, and more fulfilling.

So, how do we master this “dance?”

The dance

Much like these billionaires, we often chase one of these pillars and sacrifice the others.

Surveys show that no matter the level of wealth, everyone thinks double to triple their current level of wealth will be “enough.” It’s clear that there is no such thing as “enough.”

In the midst of chasing financial freedom and “enough,” we give up our personal freedom.

We grow the company from $1 million to $10 million to $100 million because we don’t know how to stop.

As the company grows, the demands on your time increase, actually resulting in less freedom of time than you had at a lower level of wealth.

If you automate and create systems, you are able to scale and keep a level of personal freedom, though it doesn’t always work as expected.

Some argue that you need a level of financial and personal freedom so you have time for philosophical freedom.

But, I’d argue that if you’re chasing financial and personal to one day get philosophical freedom, it’ll likely never happen.

In my view, philosophical freedom should drive the other two. Your desire to do good and help others should change the way you approach money and time.

If you understand what fulfills you, it should drive your actions financially.

The goal should be to chase a mix of the three freedoms, not one independent of the others.

But, we run into 2 big challenges when going down this road:

Staying patient

Staying balanced

Patience

My wife and I recently went to the one-year check-up for our little boy and saw this on display. Our one-year-old is strong-willed, which means that he wants what he wants when he wants it. As we sat in the room, he wanted to get down and explore. As he flips and flops in my arms (he “throws” himself to try and get loose), I see a mom with a newborn and toddler walk in.

The toddler sees the workers doing patient check-in and says “HI” to them while enthusiastically waving.

The worker is on the phone with another patient, so they cannot actively engage him, which leaves the toddler frustrated. So, naturally, the toddler screams it louder.

HIIIIIIIIIIIIII

The mother, realizing what was going on, tells the toddler “Son, you need to wait for the lady to get off the phone.”

Of course, we all know this story doesn't end here… the toddler continues to try and say “HI” and continues to get corrected by the mother. This ultimately leads to a mini-meltdown and some stern lessons delivered by the mother.

You may laugh at that story, but we’re not much different as adults. A lack of patience is part of the human condition.

We consistently expect direct feedback from our inputs.

We went to the gym, so we should lose weight.

We paid for the ad, so the sales should go up.

We corrected the employee, so their performance should improve.

The reality is, results are rarely linear.

James Clear demonstrated this clearly in this now maybe overused visual:

For a long time, it looks like nothing is happening. Then, results seem to “appear.”

Personally, I’ve seen this in growing my Twitter account. From July 2021 to December 2021, I grew from 0 to 4,000 followers. I was happy with the result and knew about the power of compounding. So, I got aggressive and set a goal of 40,000 followers by December 2022. Today I sit at 110,000!

Even “understanding” the concept, I couldn’t fathom what was possible.

This is often the case in life, but we can only see those results with the right dose of patience.

Balance

Balance is so difficult because it’s an abstract concept, which makes it hard to measure without personal biases.

We trick ourselves into thinking if we just get a little more money in the bank we’ll have time to chase the other Pillars of Freedom.

The problem is, “just a little more” is a moving target.

I’ll acknowledge that you can chase or focus for a short period of time and get really outsized results. Frankly, this newsletter is an example of just that.

But the problem comes when you continue to make never-ending sacrifices along the way.

To avoid this cycle, you need to:

Reflect regularly

Record your decisions

Have an accountability partner

Reflection forces you to pause. By recording your decisions and thought process you can’t lie to yourself about your past beliefs. An accountability partner then forces you to answer the questions you’re unwilling to ask yourself.

I have a group of men that I meet with on a weekly basis and we talk about all things personal and spiritual. We’re forced to share what we’re going through, which I find most men aren’t comfortable doing.

I’d encourage you to seek the same. Whether it be from one person, or a group, having people who ask you tough questions and hold you to account is basically a superpower.

Wrapping Up

Freedom is an elusive concept. We may think we know what freedom is for us, but when we get “there” we realize it wasn’t what we expected.

It’s why I’m so passionate about doing things that matter TODAY. By choosing what matters to us, we’re choosing today over a future promise.

I’m also a believer that as we become aligned in our Pillars of Freedom, results become inevitable. While it may not be the way to the most immediate riches, it’s the way to the best possible long-term outcome.

Yes, this is impossible to measure. But, I think we ultimately know it’s true.

—

I really enjoyed my conversation with Brian Luebben and think you would too.

If you’re interested in hearing the conversation, you can give it a listen here.

Something Interesting

My friend Alex Banks just started a series on raising funds for your startup (read part 1 here). In his newsletter, Through the Noise, he cuts through the noise in startups and tech each week. Join 14,000+ creators, entrepreneurs, and investors today.

How do you get the best returns when investing? By having a long-term mindset. Each Wednesday Brian Feroldi’s newsletter “Long-Term Mindset” shares 5 timeless pieces of content that encourage long-term thinking. Join 40,000+ today.

I’ve been continuously fascinated by the drip of FTX news that comes out, which I’m sure you can tell based on my last 2 issues. This week, I came across this article (via Trung Phan) which outlines how the 26th smallest bank in the US got embroiled in the FTX bankruptcy. Read about it here.

I just finished reading the book More Money Than God: Hedge Funds and the Making of a New Elite by Sebastian Mallaby. It’s a fascinating telling of the history of the hedge fund and its progression through history. Check it out here.

Interested in learning more? Here are 3 ways I can help:

Purchase the Financial Statements Decoded eBook.

Join the waitlist for my cohort Beyond the Numbers. Next one is in January!

Work with me 1-on-1 to optimize your financials and create a financial dashboard that will increase profit (booked through December 2022).

As always, reply to this email if you have questions, feedback, or opportunities to partner. I love chatting with everyone!

See you next week,

-Kurtis