- Frameworks & Finance

- Posts

- WTF FTX?!?

WTF FTX?!?

What happened with FTX and what it means for you.

Today we talk about FTX. This grew so much, I’m actually making it part 1 of 2.

Today we talk about what happened and take a peak at the financial statements.

Next week we’ll dig into the red flags and how to see them in your business.

If you were forwarded this email, my goal is to share one thing each week that changes the way you think about money. Subscribe below:

A message from The Competitive Edge

As a business leader, you have a few big decisions that will 10x your growth or sink your business.

That's why I'm a big fan of Brian and his newsletter. Every week he shares simple tips to help you make the big choices that grow your business.

Join 7,000+ business leaders and check out The Competitive Edge to help position your business to grow:

|

WTF FTX?!? - Part One

As the stock market has faltered and inflation is on the rise, Crytpo was supposed to be the alternative we’d always wanted.

Instead, crypto has imploded with multiple bad actors ruining the party for everyone. Terra Luna, Celsius, now FTX, which has made all other frauds look like amateur hour.

In all honesty, I believe it has fundamentally broken trust in crypto as an industry and can see this causing a multi-year “winter” in the space. I’m curious, but in no way qualified to say what is next for crypto and how the market might transform to become a place where these revelations are no longer a regular occurrence? It’ll be a rocky ride.

Over the last 10 days, as I watched the FTX debacle unfold, I was left with a sense that it was all avoidable. As I’ve reflected back on their story, red flags were everywhere and should have caused qualified people to pause and ask questions.

So, what gives? Today I reflect back and break down what happened and what we can learn. The lessons are plucked from their saga but will apply to you and your business, as well.

Let’s dive in.

Backstory

For those of you who aren’t familiar with FTX, let me start with a little of the background.

FTX was founded in 2019 by Sam Bankman-Fried (known as SBF), who had previously started a crypto hedge fund, Alameda Research (this won’t be the last we hear of them).

One of the early investors in FTX was Binance, which was (and is) the world’s largest crypto exchange.

The exchange created its own coin, FTT, which was to be used on the platform. The coin has no intrinsic value other than the value people assign to it, which is common when launching an exchange. That means that FTT’s strength as a coin is directly tied to people’s confidence in FTX as a company.

From the very beginning, FTX grew rapidly. As investment continued to pile in from blue chip firms like Blackrock, Sequoia, SoftBank, and Tiger Global. As the company grew, the influence of the company and its CEO, SBF, grew just as fast (if not faster).

FTX bought Miami’s stadium naming rights, signed high-profile athletes (Tom Brady & Steph Curry), and even ran a Super Bowl ad (see the links of interest section for funny side-bar on companies who run Super Bowl ads).

SBF was on magazine covers, bailed out high-profile crypto funds (and compared to JP Morgan), and became the 2nd biggest donor to Biden’s presidential campaign. He very publicly claimed to live frugally and espoused effective altruism (see below), which made him a media darling.

Turns out he decided to give before earning instead.

— Michael Girdley (@girdley)

2:13 PM • Nov 12, 2022

The first cracks in the foundation

FTX kept growing and found itself the 2nd biggest crypto exchange only behind their investor Binance. Binance, wanting to distance itself from its now main competitor, sold its stake in FTX and received FTT tokens as part of the deal (this is key).

As inflation continued to spiral upwards in 2022, crypto assets were hit hard. This resulted in a number of failures, which SBF and FTX swooped in to save. We now know that FTX was struggling as well and that SBF “borrowed” customer deposits to plug the hemorrhaging Alameda.

Timeline for how Fed rate hikes led to the crypto crash which led to SBF taking FTX funds to try and save Alameda Research:

— Trung Phan (@TrungTPhan)

5:24 PM • Nov 10, 2022

The bombshell report

On November 6, the storm started brewing.

Binance announced that they would liquidate their FTT coins based on “revelations” from a Coindesk report that almost half of Alameda’s assets were FTT tokens.

The report highlighted the previously muddied relationship between FTX and Alameda. Alameda likely bought FTT tokens at the beginning, getting gains from FTX’s rise. Then Alameda trades FTT back to FTX as collateral while borrowing the actual assets from FTX’s customers. Here is a brilliant and funny explanation from Twitter:

Imagine McDonald's makes its own money, let's call them clown-bucks, keeps most of it, and sells some to the market.

McDonald's then uses their remaining clown-bucks as collateral for actual loans.

And then people remember clown-bucks aren't real.

— Lyn Alden (@LynAldenContact)

7:26 PM • Nov 8, 2022

While Binance CEO Changpeng Zhao's (known as CZ) intentions are unclear (there was a clear “beef” between the two CEOs), what happened next is extremely clear…

As SBF tried to assure people all is fine, consumer confidence was rightly shaken. That resulted in $6 billion of FTX customer withdrawals, which forced FTX to announce that they were throttling withdrawals.

On Tuesday, November 8th, SBF and CZ announced that Binance was acquiring FTX.

Barely 24 hours later, Binance walked away from the deal and FTX was unable to meet customer deposits with their current assets.

By Friday afternoon (November 11th), FTX filed for Chapter 11 Bankruptcy.

Within hours of the filing, funds started flowing out of FTX accounts. It appeared upwards of $600 million of customer deposits went missing.

FTX claims a hack, others find this too convenient. Me? I probably fall in the 2nd category, as it seems to follow the fraudster playbook.

In less than 7 days, FTX and SBF went from exhausted genius to fraudster on the run (word is SBF flew to Argentina). This chart showing their valuation shows how meteoric that rise and fall were.

FTX valuation history

— Trung Phan (@TrungTPhan)

7:52 PM • Nov 9, 2022

The similarities between Enron are evident as you dig into the details, but sometimes the coincidences are greater than any fiction writer could write.

Exhibit A is that the taglines for both companies were the same: “built by traders, for traders.”

The Balance Sheet

For those of you who have read this newsletter for a while, you may be saying “o boy, now we get to dig in.” If you’ve not been here, well this is where we dig in.

Remember, for the non-accounting people out there, your Balance Sheet formula is:

Assets - Liabilities = Equity

So, when FTX is said to be insolvent and files for Bankruptcy, what it’s saying is that Liabilities are more than Assets, making Equity negative.

But, you can be insolvent but not have to file for Bankruptcy! Case and point, Home Depot’s January 30, 2022 Balance Sheet shows a negative Stockholder’s Equity.

But, look around… Home Depot is operating as normal and they’ve not filed for bankruptcy. What gives?

It’s because their current assets (29,005) are greater than their current liabilities (28,693).

They can cover their short-term debts no problem. They also generate regular profits, which means they’re bringing in new cash which allows them to cover liabilities. Their negative stockholder’s equity is actually a function of them paying out too much cash in dividends and purchasing shares.

In their most recent quarter, they had turned the stockholder’s equity positive again, thus showing their ability to use cash to cover their previous overdraw.

Insolvency or illiquidity?

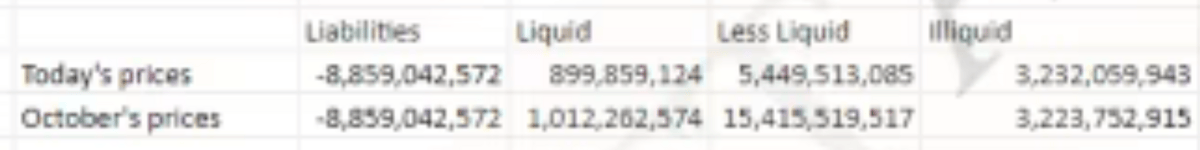

So that brings us to FTX. Here are their financials (I use this loosely as it’s just a spreadsheet).

Assets: $9.5 billion (adding Liquid, Less Liquid, & Illiquid together)

Liabilities: $8.8 billion

Notice their Assets are greater than their liabilities. Yes, I said Liabilities have to be greater than Assets to be insolvent. They are not technically bankrupt. So, why did they file for bankruptcy?

Their Assets are likely overstated. This is their own reporting and is fluid because the value of the underlying coins are always changing.

They aren’t liquid, meaning they don’t have enough assets available to them to cover their liabilities. IE: they’re unable to pay out customer withdrawal requests because their liquid cash is depleted.

SBF broke its Assets into 3 categories:

Liquid: $900 million

Less liquid: $5.45 billion

Illiquid: $3.2 billion

That means as more requests came in for funds, FTX did not have the funds to pay them because their assets were too illiquid.

This lack of liquidity is what led to the bankruptcy filing. Plus, as I mentioned above, their asset values are likely lower, meaning they’re insolvent as well.

This snapshot was after the “bank run” where $5 billion were withdrawn on Sunday, November 6th and shows the liquid assets going from $5.9 billion to $900 million. What caught people’s eye was a note of $8 billion of “poorly internally labeled” accounts.

You see, this $8 billion “gap” explains the whole situation. People put their money in FTX understanding that their money was THERE and safe. But FTX didn’t keep their money in the account. They used their money in concert with Alameda, meaning when the worst-case scenario happened they couldn’t cover the holes.

There is a lot more you can say, but I’ll just say this: leverage is dangerous, especially when dealing in risky assets.

The dangers of leverage

Leverage is a great way to grow a business quicker than you could have otherwise. But leverage can also backfire. Everyone thinks they understand leverage until they don’t.

I flashback to the 2008 crisis and all the people who thought they understood it, but then just didn’t. Many loss their houses, their jobs, and their businesses because of bad (or no) risk analysis.

So, how do you avoid these pitfalls?

Be diversified. Having high concentrations in a single asset allows that asset to take down the whole thing.

Prioritize cash flow. Cash is king, but cash flow is queen. Positive cash flow allows you to dig out of any holes that are created.

Keep your portfolio a mix of new loans and free and clear assets.

Establish a minimum value of liquid assets. When you fall below, do the “nuclear” options.

Create a plan before you need it.

This is not all-inclusive but should be a good start.

Remember: the moment you think you know it all is the moment you get humbled. Stay humble and stay diligent.

Something Interesting

We talk a lot about the numbers of business in this newsletter, but the hidden costs are just as dangerous. A few weeks ago I released a podcast episode talking about that, which you can listen to here.

If you shorted Super Bowl advertisers over the years, you’d be extremely rich. The Hustle looked at startups that ran Super Bowl ads in the 2000s and asked where they are now.

If you’re interested in the weird theories behind FTX, here’s a doozy of a thread that talks about them.

Friday night, when the bankruptcy and hack (wink) took place was pretty crazy. Here’s a thread where it was live-tweeted (and proves why Twitter is the greatest).

My friend Ali used the FTX situation to talk about the difference between illiquidity and insolvency. Give it a read here.

Thank you for reading--see you again next week.

If you're interested in learning more, here are 3 ways I can help:

Purchase the Financial Statements Decoded eBook.

Join the waitlist for my cohort Financial Statements Decoded. Next one is in January!

Work with me 1-on-1 to optimize your financials and create a financial dashboard that will increase profit (booked through December 2022).